There is a giant conference taking place in Sydney, Australia right now where all the usual mainstream nutritional suspects are conferring, confabbing, and otherwise hobnobbing about the worldwide obesity epidemic. Any time this many self-important academic nabobs get together in an effort to solve important problems, you can bet that at least one, if not a dozen, moronic recommendations will be in the offing. The Sydney conference did not disappoint.

One of the presenters, Barry Popkin, from the University of North Carolina has made the recommendation that countries facing an obesity crisis should add a tax to sugary soft drinks to make them much more expensive. Much more expensive soft drinks would shift consumption to less sugary products. As Dr. Popkin put it

If you doubled the price … of a regular Coke, people would drink Diet Coke or water, or milk or juice or something.

Ignoring the fact that Dr. Popkin has himself castigated fruit juices as being no better than soft drinks in terms of sugar content, will taxing soft drinks mean people will consume less sugar?

It sounds reasonable, at least from an economic perspective, but will it really work? If it would reduce consumption of high-fructose corn syrup, I would be all for it, but I fear that it really isn’t that simple.

I think Dr. Popkin has run afoul of the philosopher George Santayana’s famous saying:

Those who cannot remember the past are condemned to repeat it.

Or, in Dr. Popkin’s case, those who never knew the past are condemned to figure it out the next time around.

I posted a few weeks ago on some old nutritional research I had come across published in 1970 by researchers at the University of London. Said little book, which set me back about $30, is a report on the dietary studies of Dr. Edward Smith done in the early 1860s in various areas of England. These studies were the first comprehensive nutritional surveys ever done and are extremely revealing. At some point I plan to post on the entire survey, but today I want to look at the portion that is germane to a discussion of a soft drink tax.

I posted a few weeks ago on some old nutritional research I had come across published in 1970 by researchers at the University of London. Said little book, which set me back about $30, is a report on the dietary studies of Dr. Edward Smith done in the early 1860s in various areas of England. These studies were the first comprehensive nutritional surveys ever done and are extremely revealing. At some point I plan to post on the entire survey, but today I want to look at the portion that is germane to a discussion of a soft drink tax.

One of the many groups of people surveyed were cotton workers, who, of all the so-called indoor workers, made the most money and had the highest standard of living. (Dr. Smith compared the diets of indoor workers to those of outdoor workers, and compared the diets of the various indoor workers)

When he first surveyed the various groups in 1861 the diets of the cotton workers reflected their higher levels of income. Their diets contained more calories and pretty much more of all the components surveyed. A depression swept through the area where all the cotton workers were employed in 1862, cutting their incomes by about half. The depression didn’t affect the other indoor workers nearly as much as it did the higher paid cotton workers.

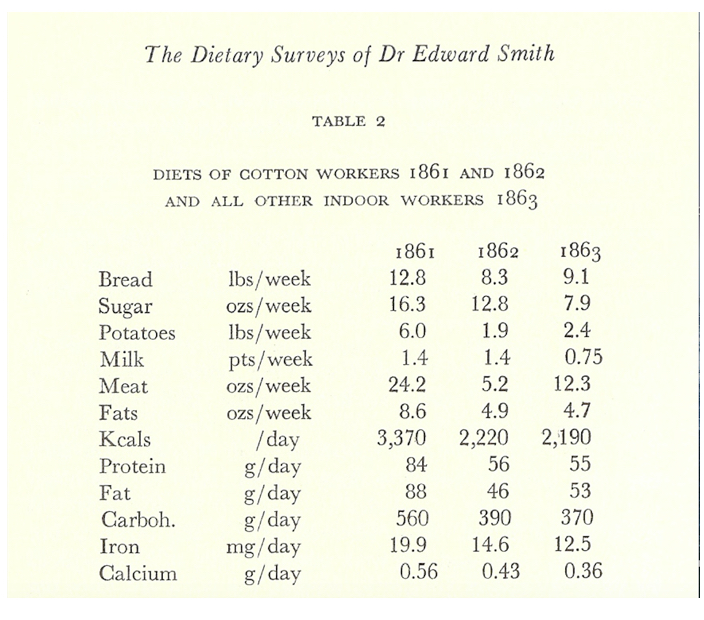

You can see from the chart above the impact the depression of 1862 had on the diets of the cotton workers. The first column is the diet that the cotton workers consumed in 1861 while they were earning a substantial income. The second column shows the change in diet as a consequence of reduced earnings during the depression of 1862. The third column shows the diet of other indoor workers in 1863 while the depression was still present. (I haven’t shown the other charts in the book showing that the diet of the other indoor workers prior to the depression was virtually the same as that shown in the third column.)

What does all this tell us that is relevant to the idea of a soft drink tax?

If you’ll look at the chart and compare the first column with the second, you will notice a substantial decrease in the amounts consumed in almost every category except for sugar (there is not much decrease in milk, but there wasn’t much to start with). Relative to every other category, sugar consumption decreased less with falling income. All the categories fell to the point that they were similar to that of the other lesser-paid indoor workers.

Except for sugar and meat.

There was a small reduction in sugar intake, but a large reduction in meat consumption. They ended up eating far less meat than the poorer workers.

What this tells us is that once people started making more money and developed the taste for sugar (which was relatively expensive back then) they didn’t want to let it go. When times got hard, they continued to spend on sugar and got rid of the meat, bread and potatoes.

As the authors of this report put it

Whilst the previously higher levels of bread and potatoes of the cotton workers fell to about the same levels as those of other indoor workers, sugar remained appreciable higher, and the meat and fats became much lower. The effect of these and other changes was to reduce the amount of calories and nutrients in the diet to a level that was now quite close to the average of the indoor workers. The sugar consumed during the depression consisted in a significantly higher proportion of treacle than that consumed before the depression–about 40 percent of the total compared with less than 25 percent. It was mostly spread on bread, so it was used as a substitute for butter rather than for solid sugar in drinks and cooking.

In nutritional terms, it would have been better if some of the money spent on sugar had been diverted to buy bread and potatoes, since this would have given them very many more calories for the same money, as well as providing some protein, vitamins and minerals, which sugar lacks entirely. In fact, however, we find that a taste for the sweetness of sugar tends to become fixed. The choice to eat almost as much sugar as they used to do, whilst substantially reducing the amount of meat, reinforces our belief that people develop a liking for sugar that becomes difficult to resist or overcome.

Indeed.

So, based on the experiences of the cotton workers, I suspect the same thing would happen were we to levy a huge tax on sugary drinks. The sugar junkies of today would simply continue to feed their habits at the expense of more nutritious foods as did the sugar junkies in 1862.

I suspect that the outcome of this tax, were it ever to be initiated, would be another example of the law of unintended consequences at work.

In my opinion, a much better way to attack the problem is with education.

I firmly believe in a sin tax on many, many items that affect our health as necessary simply to take up the costs that those items would incur in our health system. The user should be the one paying the tax, not anyone else. For instance, I believe that recreational drugs should be decriminalized and the programs that might become necessary for addiction be paid directly from the sales of the drugs themselves. The same with prostitution, the use of certain other substances, high risk sports and their equipment, etc.

I don’t believe in legislating morality. I think Prohibition was one of the stupidest things this country ever engaged in. A certain number of politicians and prominent citizens thought the American public would be such sheep, that they would just obey the new law, and boy were they ever surprised. I think people should be able to engage in whatever behaviors they wish, but the manufacturers, facilitators, and participants of any risky behaviors should not expect others to take up the costs. Rather they should pay at the front end with a tax or licensing and handling fees.

The sales of all sugared drinks, no matter whether sodas, waters, or juices, for example, would be taxed to handle the rise in health costs we all know they already incur. An incentive to reduce the harm in some corporation’s product would be that a reduction in high risk content, whether sugar or something else, would result in a reduction in tax.

This gives everyone the choice–the corporation can modify the product to modify the tax, and the individual can decide how often to engage in the product or behavior.

Those who never engage in such products would not have to pay at the back end with any other kind of tax or bond. Users pay at the front end, nonusers don’t pay at all.

Hi LCforevah–

I agree with you 100 percent that those who engage in risky behaviors should pay for them in advance so that the rest of us don’t have to pay for them later…except for one little thing. Who is going to decide what risky activities are? If we left it up to the nimrods in charge today, there would be a tax on beef, pork, cheese, and any other food that contained saturated fat. Margarine and Crisco would have gotten a free ride up until just recently. I would be afraid to let the bozos who ‘govern’ us make the call as to what is a danger to me. And there’s the rub. If we had enlightened and intelligent leadership it might be a different story, but I would be afraid to put any such decisions into the hands of the dolts in charge right now (and I don’t mean just the Republicans–I mean any and all politicians of almost any stripe).

The point of my post was that a tax on soft-drinks, based on an historical precedent, was unlikely to have the desired effect, i.e., the reduction of soft drink consumption.

Thanks for writing. I always enjoy hearing from a fellow Libertarian.

MRE

Wow, great article. Thanks.

Instead of taxing soda, I wish we’d just remove the subsidies for HFCS.

Education is a start but the dollars would need to meet or exceed those of ag policy and advertising dollars. hmmmm

Hi Connie–

You’re right on the money about the subsidies to HFCS. I meant to mention that in the post when I set out to write it, but had forgotten by the time I got to the end. Thanks for bringing it up.

MRE

Alot of the farming subsidies should be voided altogether. If Archer Daniels Midland couldn’t afford to put HFCS in our food, the incentive would be there to find more efficient ways to to make corn into ethanol, since right now it’s more energy wasting than producing. I think corn belongs inside my gas tank, not my body.

Dr Mike, there’s a certain tension between society and the individual that will always be there — how do we decide taxation–do we tax meat, or sugar, for instance. The decisions have to be made, not avoided.

That’s why democracy is so messy and terrible–and the best thing this world’s got going. It’s up to every individual to participate, because it’s not only the nimrods in charge who do bad and stupid things, it’s the apathetic citizenry who lets them do it. The American public forgets that WE THE PEOPLE are the government, and then sit on their behinds complaining.

I do belong to a couple of groups trying to establish connections and change things–I am putting my money where my mouth is.

I agree that virtually all farming subsidies should be eliminated. And I agree that a democracy (or in our case, a Republic) is the best thing going, and I agree that it is the apathetic citizenry that keeps the losers in office, but I don’t see it changing a whole lot. The sad thing is that a majority of people don’t even vote, may because they figure it doesn’t matter who is in office, things never really change. The political system we have ensures that nothing but ambitious, power-hungry people reach the top levels. We have no statesmen (or women) and haven’t for a long time. Maybe if we made public service a little less lucrative we could get some decent people. Believe me, I understand your frustration.

Best–

MRE

Even if this tax is successful, and people buy fewer sugary beverages because of it, I have a feeling that the price of diet drinks will be raised in order to make up for the loss of profit on the sweeter beverages. (IE: Diet Coke’s price goes up if regular Coke sales fall.) However, I received a C in economics, so I’m probably incorrect.

Hi Lyndsey–

If a tax raising the price of sugary beverages makes consumption go down, then a price increase would make consumption go down even more. Since the margins are pretty high on sugar water (it doesn’t cost much to make yet sells for a fair amount) I suspect the manufacturers would lower the price somewhat to compensate for the tax, keeping consumption high, and still make plenty of money.

Best–

MRE

Really when you look at it all these measures will make no difference. A junkie doesn’t care how much he has to pay for his drug of choice. In this case neither would the sugar junkie. All we can rely on in this mass media world is that people like Dr Eades keep on putting the message out there & people like us keep talking about it. We may not save the world but we may change the lives of those we love.

Hi Helen–

We’re all trying.

Best–

MRE

My husband, bless his heart for putting up with me, is a sugar junkie like you wouldn’t believe. I haven’t gotten him off it completely but he’s much better than he was. At least I’ve finally succeeded in getting him off HFCS-laden soda.

I agree that taxation of “bad” foods wouldn’t be a great idea right now given that foods high in the dreaded saturated animal fats would be among the first to be taxed.

Right you are.

MRE

Were they really able to work out the carbs/protein/sugars etc in the 1860’s? Did the term kcals exist? How did they work it out anyway?

Hi Lynne–

They used pounds and ounces of food consumed. The calculations done today were converted from those measurements.

Best–

MRE

Greetings, Mike —

I asked Dr. Oliver from the University of Chicago about proposals to tax foods not approved by the dietary dictocrats when I interviewed him for my film. He said economists have told him taxes like this are not effective unless they’re ridiculously steep. For example, you’d have to slap a $4 tax on 12-ounce sodas to cut their consumption in half. Then a black market typically sprouts, and you turn people into criminals.

I may or may not use that specific clip in the film, which you’ll see soon enough, but I thought you’d like to know.

I’d be against taxes like those proposed, even if they were effective. Once they tax the sodas, they’ll be after my sausage patties and eggs next.

Tom Naughton

Hi Tom–

Thanks for the feedback on the economics of food taxation.

Like you, I’m not in favor of the bureaucrat du jour levying taxes on any kind of food.

Cheers–

MRE